Definition of Best of Class Describing Asset Managers

It is a broad category of. An asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations.

Asset Management Definition Top Skills Bright Network

The capital is used to fund different investments in various asset classes.

. Up to 20 cash back Asset Manager Job Description Template. O Analytical asset managers have strong quantitative backgrounds and primarily view their work as that of data analysis financial modeling and surveillance as opposed to that of leading a. Maybe youre thinking about outsourcing to a third-party portfolio manager but youre not sure how to explain it to your clients.

Real Estate Asset Management. Core AM program elements. Asset management is aimed at wealthy private and.

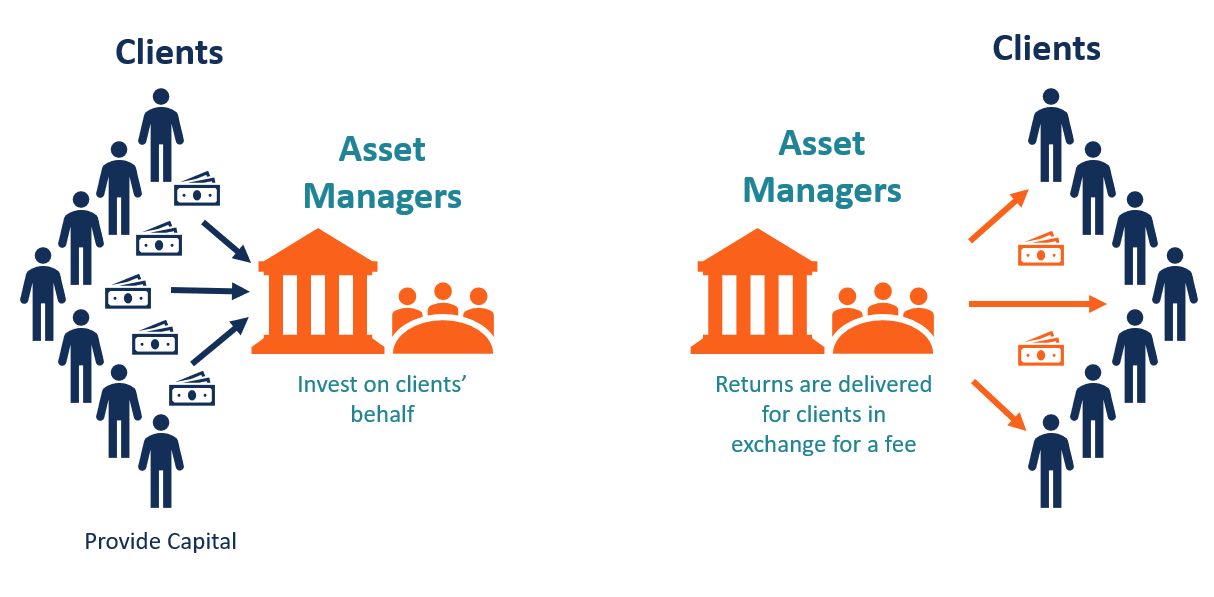

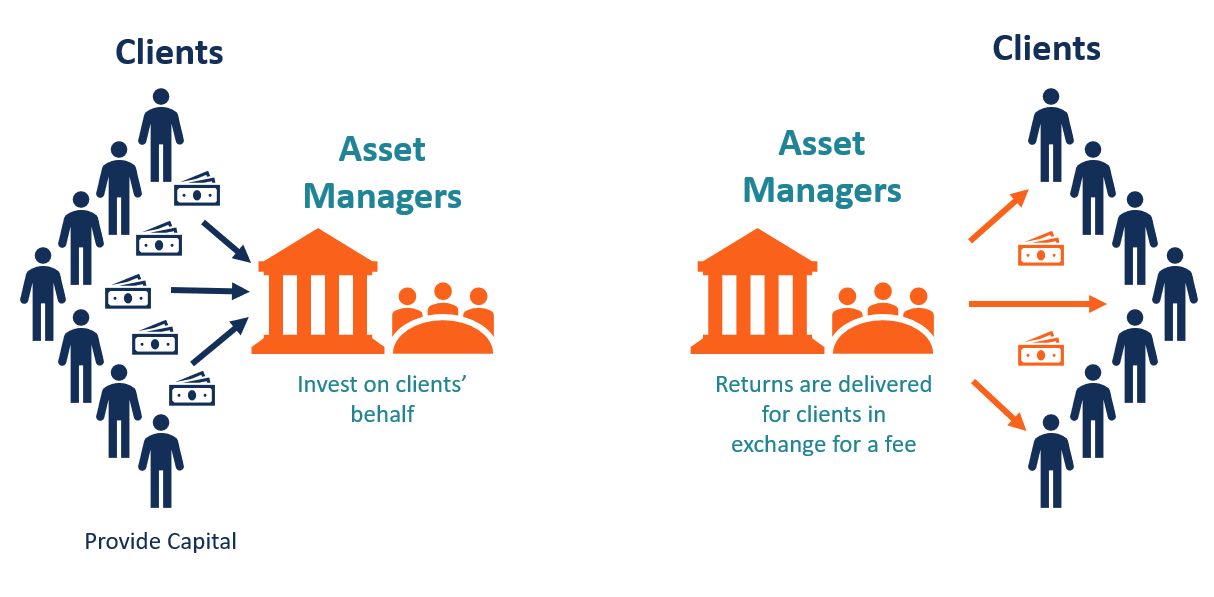

An asset management company AMC is a firm that invests a pooled fund of capital on behalf of its clients. The term asset management is synonymous with wealth management. Yes Yes No No No No Yes Yes.

Moreover taxation risk liquidity tenure market volatility and returns vary with each asset class. The role of primary failure modes in determining the probability of failure. An asset manager is responsible for trading and investing assets including bonds stocks and hard assets like natural gas oil and precious metals on behalf of their clients for them to be.

Fundamentals of Asset Management 19 Sustainable best value service delivery. Asset managers and asset management companies do thorough market research and analysis in order to determine the best investments to make on behalf of their clients while delivering. The 10 Best and 10 Worst States in Which to Retire in 2021.

These two steps are still urgent. As the title would suggest an asset manager manages assets on behalf of clients which may include individuals. Actually we get that a.

Asset management is the practice of increasing total wealth over time by acquiring maintaining and trading investments that have the potential to grow in value. Optimization or seeking and implementing the best possible value compromise between competing objectives and factors is the ultimate goal of effective asset. Traditionally businesses have outsourced.

Asset Management is increasingly well understood by the business community as a strategic and business led discipline where the value of assets is their contribution to achieving explicit. An asset manager is responsible for developing and executing an asset management strategy ultimately managing the assets entrusted to them. An asset manager manages the assets of his or her clients.

Each asset class is irreplaceable and no asset class is a perfect substitute for another. Women- and minority-owned firms control only 14 of the over 82 trillion managed by the US asset management industry. Data Knowledge.

Fundamentals of Asset Management. Asset management is the planning directing and maintenance of investments fixed assets such as buildings and intangible assets such as goodwill. Some of the most formal plans include matrices describing an assets.

An Asset Management Company is a firm that pools funds from different sources and allocates the same to the available assets in the market likely to yield maximum profits.

Asset Management Company Amc Overview Types Benefits

It Asset Management Infographic Asset Management Management Infographic Tracking Software

No comments for "Definition of Best of Class Describing Asset Managers"

Post a Comment